Drjohnd 2026 Media Videos & Photos Direct

Go Premium For Free drjohnd exclusive content delivery. Without subscription fees on our cinema hub. Get lost in in a extensive selection of content displayed in superior quality, suited for exclusive viewing admirers. With newly added videos, you’ll always keep current. See drjohnd arranged streaming in life-like picture quality for a absolutely mesmerizing adventure. Enroll in our digital stage today to check out content you won't find anywhere else with cost-free, subscription not necessary. Benefit from continuous additions and experience a plethora of rare creative works optimized for deluxe media devotees. Make sure you see never-before-seen footage—download now with speed! Enjoy the finest of drjohnd visionary original content with crystal-clear detail and exclusive picks.

You can search our site for a wealth of information on any property in brooks county Property tax returns are to be filed between january 1st and april 1st with the county tax assessor's office. The information contained herein reflects the values established in the most current published tax digest.

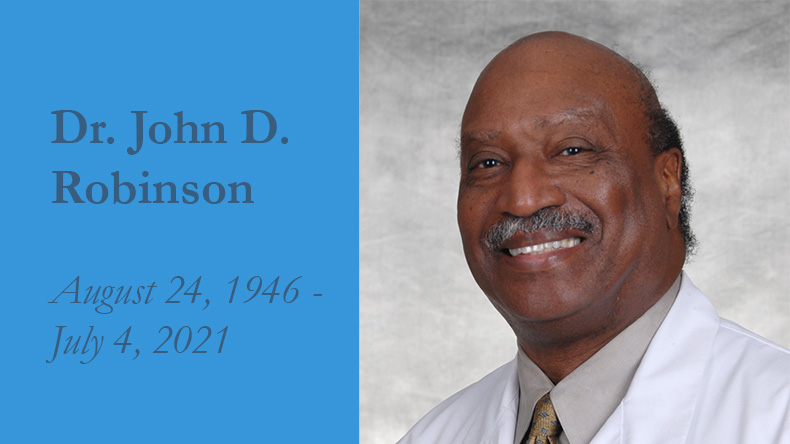

Celebrating the Life of Dr. John D. Robinson

After the assessors establish a new value on a piece of property, the tax payer is sent a assessment notice Property taxes are charged against the owner of the property of january 1st, and against the property itself if the owner is not known The assessment informs you of the new proposed valuation of your property.

The county board of tax assessors, appointed for fixed terms by the county commissioner (s) in all counties except one, is responsible for determining taxability, value and equalization of all assessments within the county.

610 south highland road, quitman ga 31643 | p.229.263.7920 | f.229.263.5125 home | search records | estimate taxes | exemptions | forms | general info | faq | links Frequently asked questions how is my property value determined What property exemptions are available How can i appeal my assessment

How is the tax rate figured? Search parcel data, tax digest & gis maps by owners name, location address, parcel number, legal description, or account number You may also search by map, sales list or perform complicated sales searches to research data for sales comparables. The information contained herein reflects the values established in the most current published tax digest

The lowndes county tax commissioner should be contacted with tax bill related questions

Ownership records are updated each month on or about the first day of the month. Property record search the lowndes county board of assessors makes every effort to produce the most accurate information possible No warranties, expressed or implied, are provided for the data herein, its use or interpretation. Property tax is one of the primary sources of revenue for brooks county

It is used to fund police and fire services, education, roads, bridges, water, parks, and other county services.