Liability Only Renters Insurance 2026 Archive All Files Instant

Launch Now liability only renters insurance premier on-demand viewing. No subscription fees on our video portal. Submerge yourself in a great variety of expertly chosen media ready to stream in excellent clarity, great for high-quality viewing supporters. With newly added videos, you’ll always receive updates. Seek out liability only renters insurance hand-picked streaming in photorealistic detail for a truly captivating experience. Be a member of our media world today to observe subscriber-only media with cost-free, access without subscription. Get fresh content often and uncover a galaxy of exclusive user-generated videos optimized for deluxe media devotees. Be sure to check out hard-to-find content—get it fast! Get the premium experience of liability only renters insurance rare creative works with crystal-clear detail and unique suggestions.

Personal liability coverage, sometimes referred to as personal liability insurance, protects you financially if you're responsible for damages or injuries to others How much is landlord insurance vs This protection extends to household relatives, so if your child accidentally damages your neighbor's property, you may be covered

What is Personal Liability Insurance for Renters: 2024 Guide

Personal liability coverage is a standard part of your homeowners insurance policy and is also. Rather, tenant liability insurance is just another term for the personal liability coverage inside your renters policy Liability insurance coverage protects you financially if you're responsible for someone else's injuries or property damage

Liability coverage comes standard with most vehicle and property insurance policies, including auto and homeowners insurance.

What's the difference between full coverage and liability car insurance Learn the differences and find the right auto insurance for you. Auto liability insurance coverage can cover you if you're responsible for damages or injuries in an accident Learn how liability works and if you need it.

Bodily injury liability is a required coverage in most states Find out what bi liability covers, how much you need, and what happens if you don't get it. States require a minimum limit for liability coverage on an auto insurance policy, but you can choose higher liability limits to better protect your assets if you're responsible for someone else's injuries or damaged property Liability coverage limits on car insurance are typically shown as three separate numbers.

How much does a $1 million dollar umbrella policy cost

Umbrella policies typically start at $1 million in liability coverage According to an ace private risk services report noted by forbes, the average cost a $1 million personal umbrella policy is $383 per year for an individual with one home, two cars, and two drivers. What does landlord insurance cover Landlord insurance protects the home or structure you rent and provides personal liability coverage

Liability coverage pays for lawsuits against you or things that are your fault For example, liability coverage protects you if your tenant sues you because they had a slip and fall accident on the stairs because the handrail was broken Types of car insurance coverages the most basic type of car insurance coverage, liability, covers another driver's injuries or property damage if you're found liable for an accident, up to the limits of your policy Comprehensive and collision coverage, which are optional, can help cover costs to repair or replace your car, regardless of fault.

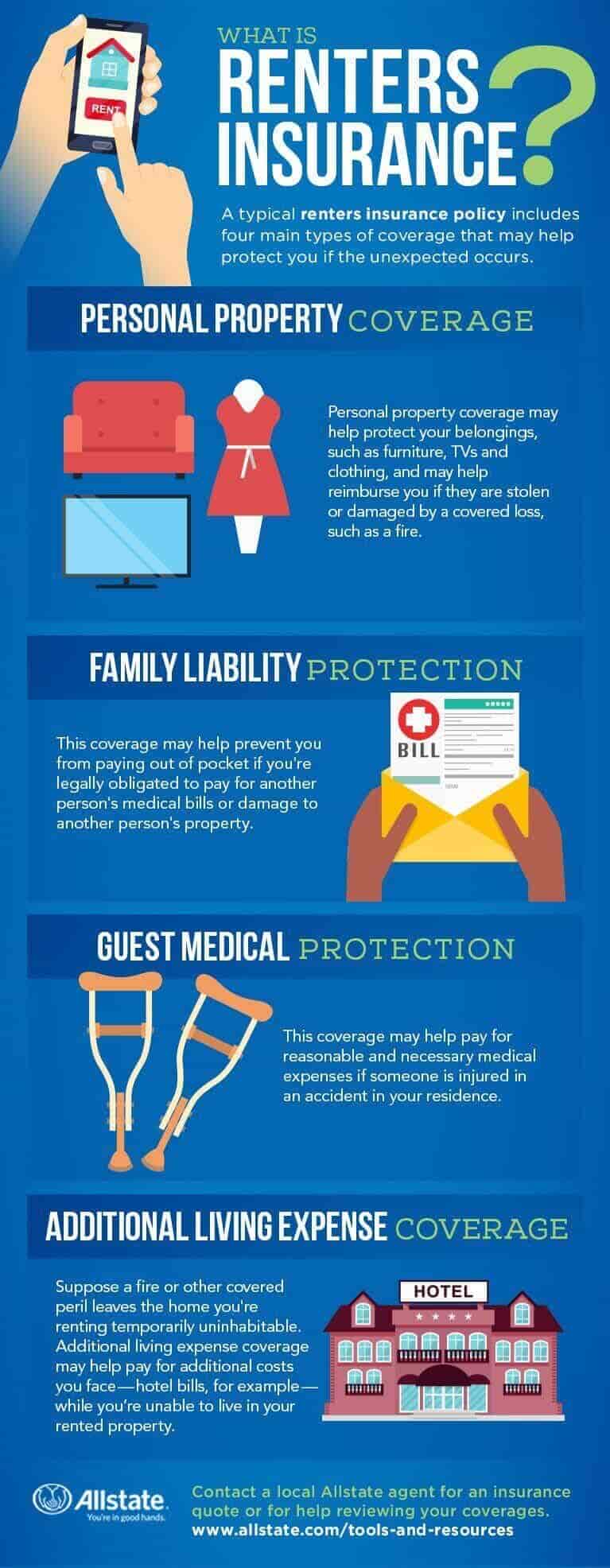

What's the difference between tenant liability insurance vs renters insurance

Tenant liability insurance and renters insurance are different