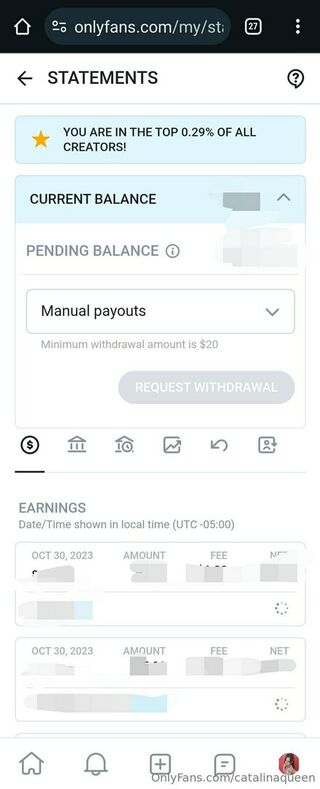

Catalinaqueen Onlyfans 2026 Folder HD Media Direct Link

Access Now catalinaqueen onlyfans prime viewing. Subscription-free on our cinema hub. Immerse yourself in a vast collection of videos unveiled in crystal-clear picture, perfect for elite streaming geeks. With hot new media, you’ll always be ahead of the curve. Explore catalinaqueen onlyfans arranged streaming in breathtaking quality for a utterly absorbing encounter. Get involved with our network today to stream VIP high-quality content with absolutely no cost to you, free to access. Experience new uploads regularly and experience a plethora of one-of-a-kind creator videos tailored for premium media followers. Make sure you see rare footage—swiftly save now! Explore the pinnacle of catalinaqueen onlyfans special maker videos with breathtaking visuals and selections.

Equity release is exempt from income tax as it's not a form of income The income which you receive from equity release is viewed as a loan, hence it is not considered taxable. It's a loan, just like a residential mortgage

catalinaqueen / catalinaqueen2019 Nude OnlyFans - NudoStar.TV

Even if you are planning to use equity release to top up your income, you are not subject to any taxation. These six essentials can shape your decision. The cash can be used as you wish and releasing equity from your home can actually reduce any inheritance tax liabilities your beneficiaries may face.

But why is this the case, and what other tax benefits can be drawn through the use of equity release?

While equity release itself is not subject to tax, it can have implications for inheritance tax (iht) By reducing the value of your estate, equity release can potentially lower the amount of iht your beneficiaries will need to pay upon your death. You do not need to pay tax on any money you receive through equity release An equity release lump sum could even reduce the tax you need to pay on other assets in your estate, depending on how you make use of the funds.

No, you don’t pay tax on equity release The money you receive is tax free, but what you do with your money may be subject to tax For example, if you don’t use your money immediately and instead put it into savings accounts, this could be taxable. Tax rules for equity release in 2025 include no income tax on the funds, but impact on benefits and inheritance planning is key